Skyline has reached a deal to sell the 850 acres of land that was to become home to Port McNicoll Resort Village.

The land, which surrounds the bay where the S.S. Keewatin is docked, has been up for sale for quite some time.

A deal was in the making earlier this year, but fell through on Aug. 31. Documents dated Oct. 25, found on the online database SEDAR (an official site that provides access to most public securities documents and information) indicate that Gil Blutrich, identified as a private individual of Israeli citizenship, no longer holds an interest in the property.

Further documents, dated Oct. 31, found on the same database indicate that the company has now reached an agreement with a "local buyer" for the sale of the Port McNicoll property for a total of $33.5 million.

Both documents are signed by Robert Waxman, chief financial officer, for Skyline Investments, who responded via email, "Sorry, we are not speaking with anyone outside of the company at the moment about this."

The document, however, indicates that upon sale, Skyline will receive $5 million of the total. The amount will be divided into $250,000 being paid upon signing of the agreement, $1.5 million to be paid after completion of the due diligence period and an additional $3.25 million to be paid upon closing.

The balance of $28.475 million will be provided to the buyer as a vendor take back (VTB) loan, bearing no interest, for a 10-year period, which will be repaid by the buyer upon the sale of the residential and commercial units to be built on the property. The document indicates that a total of $50,000 will be repaid for each unit sold.

The VTB loan will become due and payable after four years at an interest rate of 5%, on the condition if at the end of that time period the buyer has not sold at least 100 units or an amount equalling $7.5 million, less $50,000 for each unit sold not paid to Skyline. The same interest rate will apply at the end of seven years if the buyer has not sold 300 units or an amount equalling $15 million, less $50,000 for each unit sold that was not paid to Skyline.

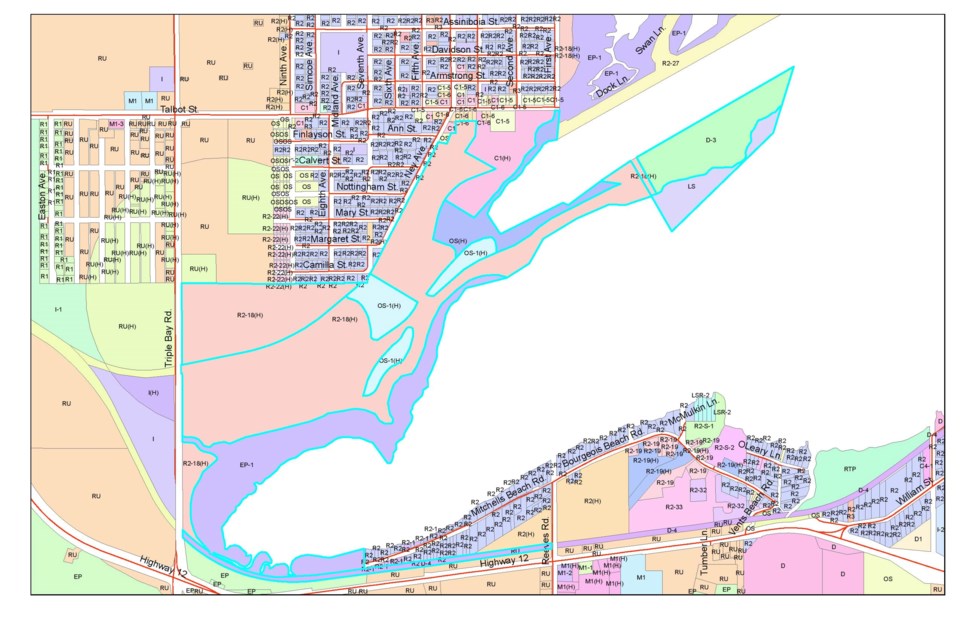

According to Steve Farquharson, Tay Township's general manager, protective and development services manager of planning and development services, the property in question is zoned to allow for a mix of residential, commercial, and open space.

"If (the buyer) wanted to change out of those zones it would require various Planning Act applications depending on what was being proposed," he added.

In addition to the sale agreement, another agreement was signed between the parties under which Skyline will provide the buyer consulting services for real estate development, which will become effective upon transfer of the title. This service will be rendered at $10 per sq. ft. built on the property and up to a maximum amount of $20 million.

The closing of the transaction is expected to take place in 120 days from Oct. 31, subject to fulfillment of several conditions precedent, including completion of due diligence.

The property has approval to develop more than 1,500 units. It is estimated that the sale and delivery of approximately 450 units will provide Skyline with cash in excess of its current VTB balance from the two agreements signed by the parties.